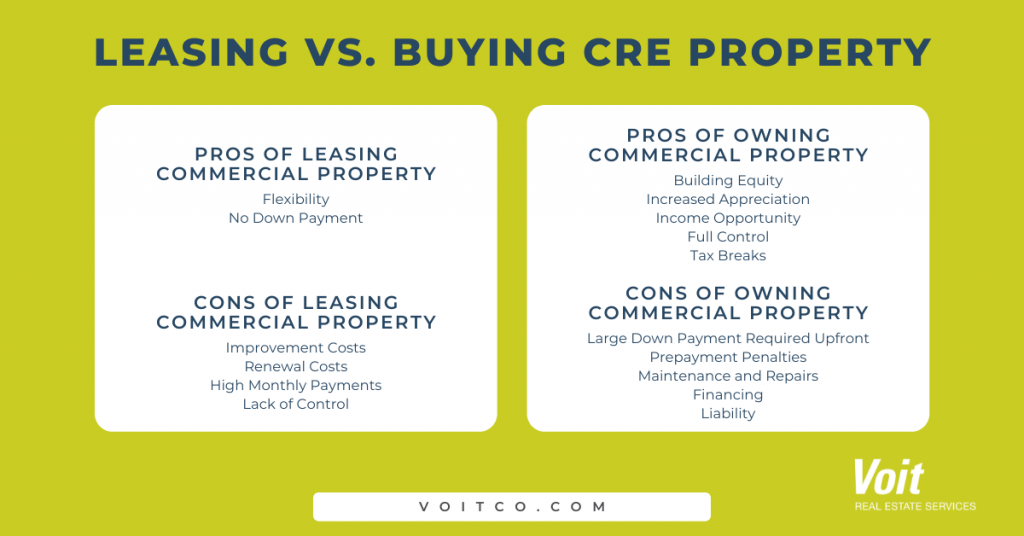

Let us paint the picture. You’re looking for a commercial space for your business. But what’s the smartest option? Should you lease or buy? While there are pros and cons to each, the decision comes down to your unique business and its needs. Here’s Lease vs. Buy: Pros and Cons, a look at both avenues to help guide you during this important decision.

Pros of Owning Commercial Property

Building Equity

The most obvious benefit of purchasing real estate is the opportunity to build equity. Whether you pay for a property in full or make monthly payments, when you invest in commercial property, you build equity over time.

Increased Appreciation

Property value increases over time. This considered, an additional benefit to buying real estate is that you benefit from capital appreciation. Capital appreciation, as defined as, “a rise in an investment’s market price… [or] the difference between the purchase price and the selling price of an investment.”

Appreciation varies, however, based on local supply and demand, interest rates, inflation rates, and additional factors.

Income Opportunity

Typically, businesses that purchase commercial real estate occupy at least 51% of the property. (This is largely due to the fact that in order to qualify for a Small Business Loan, the owner must occupy 51% or more of the property.)

In many cases then, when purchasing a commercial property, your business might not occupy the entire commercial space. This provides the opportunity for you to offset your mortgage payments by renting out the remaining space to another tenant.

Full Control

When you own a commercial property outright, it’s up to you what you’d like to do with it! (Of course, within the parameters of any zoning restrictions.) Want to paint the walls bright orange? Put furry red carpet in the kitchen? Go for it! Although we at Voit wouldn’t recommend that stylistic choice…

Additionally, when you buy property, you make fixed monthly payments toward your mortgage as opposed to a rent payment that might fluctuate when your lease expires.

Tax Breaks

Another benefit to owning a property is the fact that you can deduct interest and depreciation as a tax break on your commercial property.

Cons of Owning Commercial Property

Large Down Payment Required Upfront

Although purchasing commercial property is a great long-term investment, you shoulder a remarkable upfront cost to do so. This cost might include not only the down payment but also improvement costs, appraisal fees, loan fees, and more. Down payments, in traditional loans, typically require between 10-25% of the commercial property’s total value. A property purchased at $500,000 could cost you up to $125,000 for the down payment itself.

Prepayment Penalties

For those who like to jump the gun or pay their bills ahead of time, buying might not be the right option for you. Commercial real estate loans often come with substantial prepayment fees and penalties if your loan is paid ahead of time. If you pay a loan in two years rather than five, you avoid interest rates. The lender, however, is out the three remaining years of interest accrued on the loan.

Maintenance and Repairs

When you lease a property, the costs for maintenance and repairs are typically shouldered by the landlord. When you own a property, however, you are considered the landlord. Therefore, any maintenance and/or repair costs are your responsibility.

These costs can add up and be a deciding factor in either leasing or buying a property. Consider the condition of your property. Some individuals might decide to hire a property manager to deal with any necessary maintenance and repairs.

Financing

The process of qualifying for necessary loans or financing can be a big hurdle in the process of purchasing commercial real estate. High-interest rates can make leasing a more cost-effective option, especially in cases when interest rates are higher than 10%.

Liability

When you own a property, you are responsible should someone be injured on your property. To protect yourself from lawsuits, you will incur the added expense of a liability insurance policy. Additionally, if you rent out part of your property to an additional tenant for income, you will also be responsible for property manager liability.

Pros of Leasing Commercial Property

Flexibility

Is your company growing rapidly? If so, leasing your commercial property provides you the flexibility to accommodate your business in the future given that you’re not locked into property ownership.

Additionally, research shows that if your business plans “to stay in a single location for less than 7 years, then leasing might be a better option.” This research takes into consideration monthly recurring costs, tax savings, asset price appreciation, increased business equity, up-front costs, opportunity costs, and money earned in the sale of the property.

No Down Payment

Although a lease might require a security deposit, this cost is nothing compared to the cost of a down payment if purchasing a commercial property. (As we’ve mentioned, down payments in traditional loans typically require between 10-25% of the commercial property’s total value).

In the case of leasing, you might only be required to pay the security deposit and the property’s first-month rent. This considered, leasing is the best option for those who have not saved enough for a down payment.

Cons of Leasing Commercial Property

Improvement Costs

When you lease a property, chances are you will make some physical improvements to your space. Whether it be adding a fresh coat of paint or a more extensive renovation, this is something to consider before you decide to buy or lease.

Although you might spend a chunk of change improving leased property, any improvements made will not benefit you since you don’t own the property. Instead, making improvements while leasing a property will actually add value for your landlord.

An example of a business that undertakes substantial improvements when leasing a commercial property is a dental or medical office. One might alternatively decide to purchase a property if landlords will not provide support in these improvement costs.

Renewal Costs

Congratulations! You love your commercial property and want to renew your lease. That’s great—until you consider renewal costs. When tenants decide to renew their lease, management companies can charge a lease renewal fee.

A lease renewal fee can either be a flat rate or in some cases can cost between 4-5% of a property’s annual rent. This cost, however, depends on your agent and the competitiveness of your specific real estate market.

For those in competitive markets, high renewal costs might present themselves. This leaves your business to either find a new lease, downsize, or renew at a high rate.

High Monthly Payments

Typically, when leasing a property, your monthly payments will be greater than a mortgage payment would be for the same property. “If your business has stable and recurring revenue, sufficient cash for a down payment plus six months of reserves, it makes sense to purchase commercial real estate,” says Noah Grayson, Managing Director at South End Capital.

“This is because a monthly mortgage payment is typically less than a monthly lease payment, meaning that buying commercial real estate saves you money over time. Further, owning commercial real estate gives you a large asset to leverage for future business needs.”

Read here about triple-net leases in which lessees are charged base rent, common area maintenance, property taxes and insurance, and utilities.

Lack of Control

A final disadvantage to leasing property is that your control over the space and its accompanying payments is limited. For example, you might be unable to decorate or paint the space in the way you please. Any damages that occur during your lease term noted by the landlord can also be taken out of your deposit to fund the fixes. Additionally, you do not have control over price increases when your lease expires.

A Well-Thought Out Decision

At the end of the day, the decision to either lease or buy comes down to your unique business and its needs. It is helpful, however, to look at the pros and cons of both—which should make the decision easier.

Regardless of your choice, your business does not have to navigate this process alone. At Voit Real Estate Services, our brokers have the experience to negotiate the best deals with your best interest at the core of everything we do.