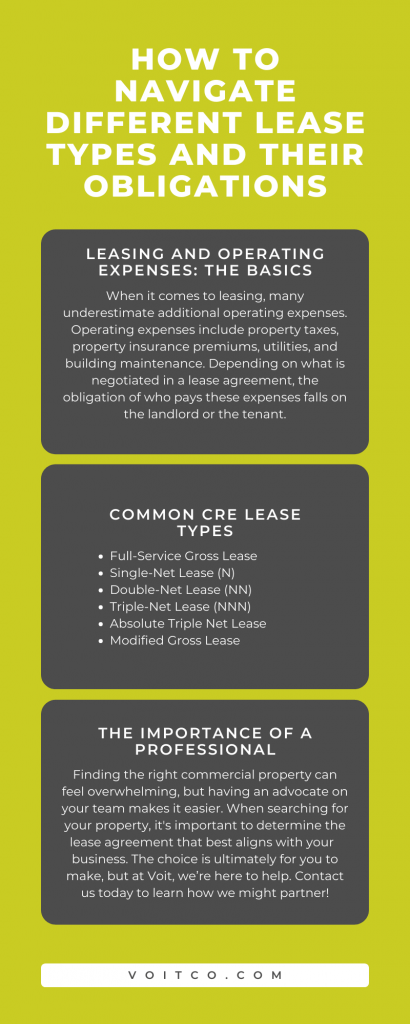

When it comes to leasing commercial real estate properties, not all leases are created equal. It is essential to understand the nuances of the different lease types before you start your property search. In short, there are many models in which landlords charge their tenants rent and operating expenses. At Voit Real Estate Services, we’re here to help you navigate different lease types and their obligations. Here we’ll explain the most common lease types in the world of commercial real estate.

Leasing and Operating Expenses: The Basics

By definition, a lease is “a contract under which one party, the lessor (owner of the asset), gives another party (the lessee) the exclusive right to use the asset usually for a specified time in return for the payment of rent.”

When it comes to leasing, it’s simple to look only at the sticker price of rent. Many underestimate the additional costs that might add up, including operating expenses. Operating expenses include property taxes, property insurance premiums, utilities, and building maintenance. Most importantly, depending on what is negotiated in a lease agreement, the obligation of who pays for these operating expenses either falls on the landlord or the tenant. Below, we will detail the different types of leases and their obligations.

Full-Service Gross Lease

This type of lease is exactly as it sounds. In a full-service gross lease, a tenant pays a base rate. All operating expenses, including property taxes, property insurance, utilities, and common area maintenance, are paid for by the landlord. Hence, why it is called full service! The landlord uses the tenant’s base rate rental payment to pay for these operating expenses.

It is obvious why this option is attractive for tenants. Having one simple monthly payment provides the opportunity to budget long-term, as opposed to net rent, which we will discuss later on.

Additionally, in a full-service gross lease, the tenant does not have to worry about maintaining the property. Instead, they can spend valuable time on their critical business tasks and goals.

Where might you most often see full-service gross leases? Multi-tenant office buildings! This is because, in these buildings, tenant utility usages are proportionate.

But remember, no lease is perfect. It’s important to note the potential for an ‘expense stop’ in a full-service gross lease. This condition allows landlords to pass any increases in the operating expenses over and above the first year of the lease back to tenants. This can lead to problems if not negotiated with your landlord upfront.

Additionally, a tenant might end up paying more in a full-service gross lease as the landlord might hike up the gross lease cost in order to protect themselves from additional expenses that might pop up for them.

For these reasons, a full-service gross lease is typically the commercial lease type of choice, even more so than triple net leases.

Net Leases

According to Investopedia, net leases are contracts in which “a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent.” Below, we have described four net lease types commonly seen in commercial real estate.

Single-Net Lease (N)

In a single-net lease, the tenant is responsible for paying the base rent as well as one (or a single!) operating expense. For example, base rent plus property taxes. Or, base rent plus insurance, and so on.

Here’s an equation for you math lovers out there:

Base Rent + One Operating Expense = Single-Net Lease

Double-Net Lease (NN)

In a double-net lease, the tenant pays base rent as well as property taxes and property insurance.

Base Rent + Property Taxes + Property Insurance = Double-Net Lease

Triple-Net Lease (NNN)

The third commercial lease is a triple-net lease. In this leasing agreement, the tenant is responsible for paying base rent plus (you guessed it!) three operating expenses. These operating expenses are generally estimated by landlords. Tenants, as a result, are then charged a portion of this estimation based on their pro-rata share or proportionate. In a triple-net lease, the tenant also usually pays for their own utilities.

Triple-net leases are most common in industrial and retail multi-tenant properties as each tenant’s expenses vary greatly. This lease type, of course, is the most desirable from a landlord’s perspective. If offered a triple-net lease, a tenant should always be prepared to negotiate and determine the range in which these operating costs can fluctuate on a monthly and even annual basis, so as to not encounter any surprise expenses. Triple-net leases make it difficult for tenants to budget in advance.

Base Rent + Common Area Maintenance + Property Taxes + Property Insurance + Utilities = Triple-Net Lease

Absolute Triple Net Lease

In an absolute triple net lease, also known as a bondable lease, the tenant pays base rent and all operating expenses in addition to a portion, or in some cases, all capital expenditures. By paying capital expenditures, the tenant is essentially paying to maintain the property condition.

Absolute triple net leases are the most extreme variation of net leases, with much of the real property risk falling on the tenant.

Base Rent + All Operating Expenses + Capital Expenditures = Triple-Net Lease

Modified Gross Lease

Another common commercial lease type is a modified gross lease. This lease type is a blend between a gross lease and a net lease. Essentially, it’s a full-service gross lease with minor exceptions. For example, the tenant may be responsible for paying specific operating expenses in addition to their gross rent.

And who might use a modified gross lease? A modified gross lease might suit tenants who have a higher risk. For example, tenants with excessive electrical power requirements might take advantage of a modified gross lease as many other landlords would find this circumstance out of the question on a full-service gross lease.

The Importance of a Professional

Finding the right commercial property for your business can feel overwhelming, but having an advocate and professional on your team makes it that much easier. When searching for a commercial property, it is important to determine the lease agreement that best aligns with your unique business.

One lease agreement might appear cheaper than another; however, the first could cost more if its operating expenses are not fully understood. Conducting an operating expense analysis with a commercial real estate professional will help you make this choice with confidence.