Sustainability Measures Improve the Bottom Line for Property Owners

It is important for investors and property owners considering “going green” with their new building project or existing asset renovation to remember that it’s not just about “saving the planet.” It’s a strategic investment that enhances your property’s long-term value and profitability.

What is Sustainability?

Sustainability, as it applies to commercial real estate, refers to the design, construction, and operation of a property in an environmentally responsible and resource-efficient manner that lasts throughout its lifespan. Sustainable buildings prioritize energy efficiency by utilizing renewable resources like solar power and natural light to reduce energy consumption. Improved ventilation and other design elements also create healthier indoor environments for occupants. At the same time, proper maintenance practices, such as regular equipment tune-ups and air filter replacements, can extend the lifespan of building systems and reduce operational costs.

Financial Benefits

Incorporating sustainable measures into your commercial property can boost your ROI in numerous ways.

Reduced Operating Costs

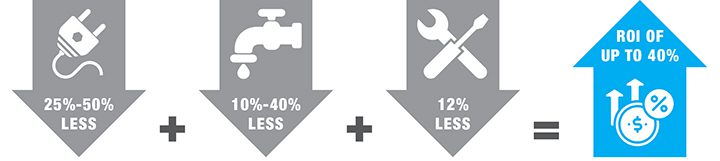

This is one of the primary reasons for building and operating your property sustainably. Energy-efficient HVAC systems and lighting, good insulation, renewable energy sources like solar, and sustainable water management practices in green buildings significantly reduce energy, water, and utility costs. The cost savings vary by research study. The most optimistic study by Smart CRE estimates that green buildings can save between 25%–50% in energy and 10%–40% in water consumption and reduce maintenance costs by about 12%. These savings can lead to a return on investment of up to 40% over a building’s lifetime. A study from ENERGY STAR found that just a 10% reduction in commercial building energy consumption can lead to 1.5X NOI.

Many property owners who are considering implementing sustainability measures are concerned about cost. According to multiple studies, upfront costs are typically 2%–7% higher than traditional building costs, depending on the level of sustainable features. However, the long-term cost savings easily offset the initial investment.

The federal government offers tax breaks and financing options for commercial property owners investing in sustainable upgrades. The Inflation Reduction Act provides significant tax incentives for businesses and property owners that invest in sustainable initiatives, including tax deductions for energy-efficient commercial buildings. Additionally, the State of California offers tax breaks and financing options for commercial property owners who invest in sustainable upgrades. Here is a list of tax incentives provided by the State of California.

Green Buildings Have Stronger Demand and Higher Rents

In the war for talent, particularly for the coveted millennial and Gen Z workforce, sustainable office space is increasingly being used as a recruiting tool. According to a 2023 Deloitte survey, over half of Gen Zs (55%) and millennials (54%) responded that they research a brand’s environmental impact and policies before accepting a job offer. Companies have noticed and are occupying space in green buildings to attract and retain top talent.

Studies have also shown that buildings with green certifications tend to command higher rents than conventional buildings. Research cited by the Institute for Market Transformation (IMT) shows that green commercial buildings in the U.S. achieve rental premiums ranging from 3%–8% compared to conventional buildings, even after controlling for factors like location and size.

Sustainable features create a more attractive and comfortable work environment for tenants, leading to higher satisfaction and a reduced desire to relocate. This translates to lower vacancy rates and a more stable income stream for property owners.

Improved Tenant Wellness and Productivity

Features like enhanced air quality, natural lighting, and green spaces in sustainable buildings contribute to a healthier work environment, improving tenant wellness and productivity. This leads to higher tenant retention and reduced turnover costs.

Increased Asset Value

Green, energy-efficient buildings tend to have higher valuations and lower risks of obsolescence compared to inefficient properties. Research cited by IMT found that green buildings achieve sale premiums of 13.3%–36.5% over conventional buildings, which directly increases their market valuations.

Enhanced Brand Reputation

In many markets—especially in Southern California—trends show consumers gravitating towards companies emphasizing sustainability. This trend can benefit property owners of sustainable buildings, particularly owner-occupiers.

Future-Proofing Investments

Sustainable properties are better positioned to comply with the increasingly stringent environmental regulations being implemented. Building owners may be protecting themselves from costly retrofits to meet future standards. This future-proofing investment also enhances the resilience and longevity of these assets.

In California, beginning July 1, 2024, commercial buildings over 100,000 square feet will be required to measure and reduce their embodied carbon. (Embodied carbon refers to all greenhouse gases emitted during the building’s lifecycle: emissions from the manufacturing, transportation, installation, maintenance, and disposal of building and infrastructure materials.) By 2026, many predict smaller buildings—those between 50,000 and 100,000 square feet—will also fall under these regulations.

Conclusion

Sustainable measures are an investment in your commercial real estate property that pays off in the long run. These investments can significantly reduce operating costs, attract and retain tenants, increase the property’s value, and lead to a higher asset sale price. All of which contribute to a higher return on investment.

If you’d like to learn more about the benefits of sustainability in your commercial building, talk with one of Voit Real Estate Services’ trusted commercial real estate advisors.