Down Payment Requirements for Commercial Properties

Are you interested in purchasing a commercial property? Prior to doing so, you’ll have to ensure all of your financial ducks are in a row—this includes knowing how much you’ll need for a down payment.

In this article, we’ll talk about down payment requirements for commercial properties as well as the different types of loans available to borrowers – SBA 504, 7(a), the list goes on.

Types of Commercial Real Estate Loans

Why might someone need a commercial real estate loan in the first place? Commercial loans can help business owners or CRE investors finance the purchase or renovation of commercial properties, including:

- Office buildings

- Retail or shopping centers

- Apartment buildings

- Hotels

- Restaurants

- Industrial buildings

Although there are many avenues available when it comes to financing commercial real estate, the three options we’re discussing today are:

- Traditional commercial mortgage loans

- SBA (7a) loans

- SBA 504 loans

All three of these financing options have repayment terms of five to 20 years and require on-premise occupancy by at least 51% of the business. Let’s dive into each a little deeper.

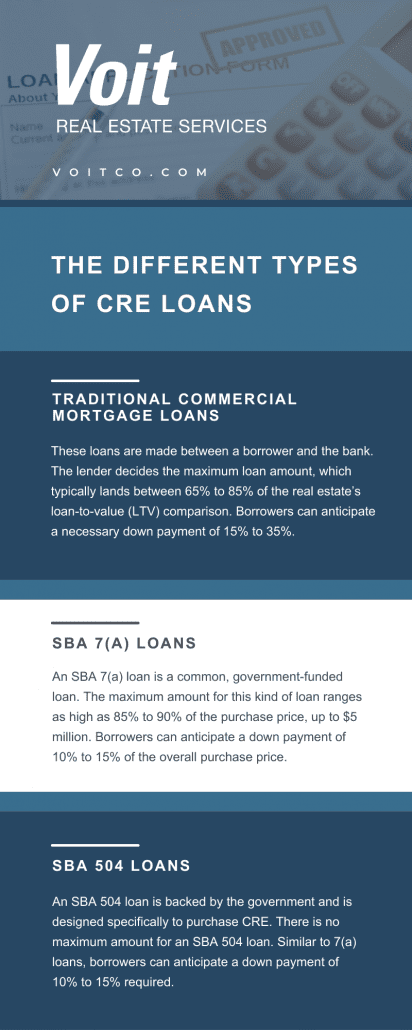

Traditional Commercial Mortgage Loans

Traditional commercial mortgage loans are made between a borrower and the bank. They are not backed by the federal government.

In this type of financing option, the lender decides the maximum loan amount, which typically lands between 65% to 85% of the real estate’s loan-to-value (LTV) comparison.

Interest rates for traditional commercial mortgages range from 4.75% to 6.75%.

SBA 7(a) Loans

An SBA 7(a) loan is a government-funded loan. In fact, it is the most common SBA loan championing a wide range of applications.

The maximum amount for this kind of loan “ranges as high as 85% to 90% of the purchase price, up to $5 million… Interest rates are within the 5% to 8.5% range.”

SBA 504 Loans

Similar to a 7(a) loan, an SBA 504 loan is also backed by the government. It, however, does not have a wide range of applications and is designed specifically to purchase CRE.

504 loans are often described as ‘two loans in one’ considering:

- 50% of the money comes from a bank or lender

- 40% from a local community development corporation (CDC)

- 10% from the borrower’s down payment

There is no maximum amount for an SBA 504 loan.

Additionally, “the SBA doesn’t monitor the rates, fees, and terms of the lender’s portion of the loan, but it does establish the CDC’s, setting 10-year loans at 4.85% fixed interest or 20-year loans at 5.07% fixed interest… Interest rates for CDC/SBA 504 loans fall between 3.5% and 5%, with a 1.5% CDC processing fee.”

Down Payment Requirements for Commercial Properties

So, how much should you be prepared to put down when purchasing commercial real estate? It varies depending on the financing option you select.

With a traditional commercial mortgage loan, you should anticipate a down payment of 15% to 35% of the fair market value of the property. The specific number, however, depends on your lender.

As for SBA loans, both 7(a) and 504, you should expect a down payment of 10% to 15% of the overall purchase price.

What Do Lenders Look For?

No matter which route you choose, remember that lenders look at your:

- Personal credit score

- Net worth (the difference between your liabilities and your assets)

- Liquidity

- Business experience

- Income

Ask yourself if you have all of those elements in check prior to purchasing commercial real estate.

Interested in learning the benefits of purchasing CRE? Check out this video where Greg Marx, Vice President at Voit Real Estate Services lists nine reasons why it’s a good time to buy a building.