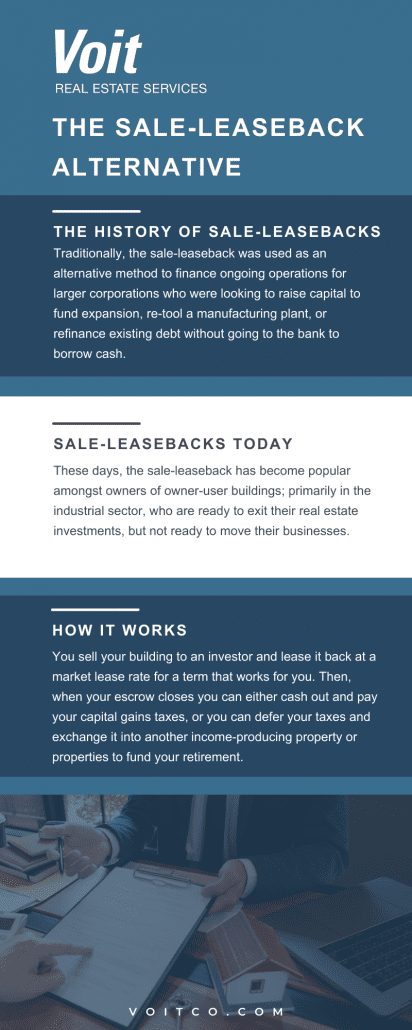

The Sale-Leaseback Alternative

The sale-leaseback concept has been around for a long time, but its application to owner-user buildings is little known and often misunderstood.

In this blog post, we’ll provide some clarity on the sale-leaseback alternative.

The History of Sale-Leasebacks

Traditionally, the sale-leaseback was used as an alternative method to finance ongoing operations for larger corporations who were looking to:

- Raise capital to fund expansion

- Re-tool a manufacturing plant

- Refinance existing debt without going to the bank to borrow cash

For those companies who owned highly appreciated real estate assets owned free and clear, it was a good alternative—especially back in the early 1980s when interest rates ran in the double digits and cap rates for real estate investment property were much lower.

It was a pretty straightforward decision. If a company could sell the property at a cap rate less than the interest rate on a loan, its lease payments would be less than the monthly debt service on the loan. Essentially, it unlocked underutilized capital to be redeployed for other purposes at a reduced cost.

Sale-Leasebacks Today

These days, the sale-leaseback has become popular amongst owners of owner-user buildings; primarily in the industrial sector, who are ready to exit their real estate investments, but not ready to move their businesses.

They want to take advantage of lofty real estate prices before a market correction and redeploy their equity to another asset to fund their retirement years.

Is this a good idea for you? It just might be.

How Sale-Leasebacks Work

It works like this: You sell your building to an investor and lease it back at a market lease rate for a term that works for you. Then, when your escrow closes you can either cash out and pay your capital gains taxes, or you can defer your taxes and exchange it into another income-producing property or properties to fund your retirement.

You might have plans to retire out of state and would like to own properties near where you will live. You may prefer to own apartment units, an office building, or a single-tenant-net-leased McDonalds or Jack-in-the-Box rather than your current property. The choice is yours.

If you choose to cash out, you will no longer carry the risk of being a property owner. If you choose to exchange, you stay in the game, but with a different risk profile. What is best for you depends on your unique circumstances and your appetite for risk.

Some owner-users like the idea of exchanging into the McDonalds and collecting a rent check for 15 years with little risk; others like the idea of moving their equity to a market and product type that has more upside potential for value appreciation.

If you have owned your own building for even a few years, it is worth more than you ever thought possible. Scarcity of product and low cost of capital has created a unique environment for prices to spike, but no one knows when current economic dynamics might change.

The sale-leaseback might just be the best of both worlds if you’d like to exit your investment and continue with your business operations from your current location.

Voit professionals can help you sort through your options. They have the experience, resources, and market intelligence in your area to get the job done.

Read on for more information on how working with an SIOR can benefit your next CRE transaction.