Despite Slowdown, Life Science Still Poised for Long-Term Growth

While COVID spelled disaster for the office and retail markets in 2020 and beyond, it set off an explosion of growth for the life science industry. The pandemic not only drove companies to pursue vaccine development, testing, and research but also generated a recognition of the need for increased research, diagnostics, and manufacturing capabilities for other health-related issues. Venture capital funding for startups more than doubled, from $6.6 billion in 2019 to $13.5 billion in 2020, to an all-time high of $31.8 billion in 2021 before leveling off in 2022. This spurred a construction boom for the industry — ground-up as well as a proportionately large number of office conversions — to meet the increased demand due to the near-zero vacancy rates in life science hubs in Boston/Cambridge, San Francisco, San Diego, and Raleigh-Durham.

Fast forward to 2023, and with the delivery of millions of square feet of wet lab and R&D space and a decrease in demand as VC funding slowed, vacancy and availability rates have increased significantly. According to one major brokerage firm, the national lab/R&D vacancy rate increased to 13.1%, well above the 8% average from 2016 through 2020. Still, much of that vacancy increase is due to the massive number of new space deliveries. Transaction volume for life science assets in 2023 was $6.3 billion, far below the $17+ billion in 2021 and the $13 billion in 2022, with over half of the investment sales of $3.2 billion in Q4.

“VC funding has completely pulled back, but that’s only relative to COVID highs,” says Chris Durbin, a life science specialist in the Voit San Diego office. “Realistically, VC funding is still at or slightly above levels we saw before the pandemic, so it’s tough to gauge because the pandemic really added gasoline to the fire in this sector.”

Still, the long-term prospects for the Life Science sector remain strong. Biotech venture capital funding may have declined from all-time highs but is still well above pre-pandemic levels. National Institute of Health (NIH) funding — which isn’t influenced by market conditions — continues to grow, reaching $38.1 billion in 2023, up nearly 25% since before the pandemic. There is currently 82.8 MSF of new construction underway, according to RevistaLab, a research firm that tracks life sciences real estate. Still, construction starts have been declining steadily since Q4 2022 — back to pre-pandemic levels. And more than half of the projects started last year were 100% pre-leased, as spec development has slowed. In Q4 of 2023, most of the top 13 U.S. life sciences real estate markets recorded positive net absorption (San Diego led the way with 211,000 SF).

Job growth in life sciences remains robust. Since 2018 (through 2021), the industry has increased its employment by 11%, and employment growth for the industry in 2023 was 2.0%. In 2021, the industry contributed $2.9 trillion to the U.S. economy, according to BIO (the Biotechnology Innovation Organization).

Impact of Life Science in California

So, what does this mean for California, and more specifically, Southern California? A report released last year by Biocom California detailed the economic impact of the life science industry on the state: the industry supports 1.19 million jobs, $129.6 billion in labor and sole proprietor income, and $413.7 billion in business output. California is the largest employer of life science workers in the nation, employing 469,756. In 2022, California added 26,672 life science jobs to its economy. This outpaced all other industries in California (4.2%) and the U.S. overall (3.5%) during the period. According to BIO, one of the most encouraging aspects of this data is that bioscience jobs have an economic multiplier effect of approximately three, meaning for every bioscience industry job generated, three additional jobs are created.

The industry is well-funded by the government and the private sector. In 2022, California was the top state in funding awarded by the National Institutes of Health and National Science Foundation, receiving $5.5 billion and $97.3 million, respectively. Three California institutions (UC San Francisco, UC Los Angeles, and UC San Diego) were among the top 15 NIH-funded institutions. Venture capital investment increased more than 50% from $11.4 billion in 2019 to $17.3 billion in 2022.

Southern California Life Science

San Diego is considered one of the big three life science clusters in the U.S., with 24.4 MSF of life science space, behind only Boston/Cambridge (56 million) and San Francisco Bay Area (47 million) according to GEN – Genetic Engineering & Biotech News. Los Angeles/Orange County is also in the top 10 with 11.4 MSF. (The publication lists the BioHealth Capital Region at #3 with 31.7 MSF, but the region encompasses Maryland, Virginia, and D.C.)

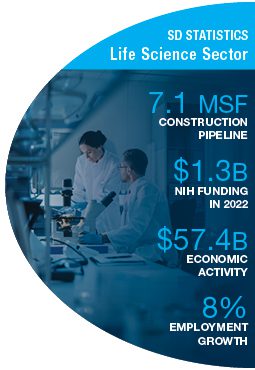

San Diego

The life sciences industry is a significant driver of San Diego’s innovation economy, with over 2,100 establishments in the county. Major pharmaceutical companies, including Eli Lilly, Pfizer, and Takeda, maintain a presence in San Diego to foster collaboration with its major research institutes like The Salk Institute and Scripps Research and its universities, particularly UC San Diego (in partnership with Boz Institute). In 2022, life science employment grew by 8% overall in the region, with average annual earnings totaling $144,000. Life science in the county directly employed 77,770 people, generated $57.4 billion in economic activity, and received $1.3 billion in NIH funding in 2022.

Although the overall occupancy rate has declined by about 320 basis points over the past six quarters (to 88.9%), according to RevistaLabs, there is more to the story. Over 2.4 MSF of lab space was delivered during that period, while absorption totaled about 1.2 MSF. Last year, for instance, Breakthrough Properties, a joint venture of Tishman Speyer and Bellco Capital, delivered Torrey View, a 442,500 SF campus. The campus was approximately 40% pre-leased (220,000 SF) to BD Biosciences. The construction pipeline in San Diego is also at a cyclical high, currently at 7.1 MSF, up dramatically from 4.1 MSF in Q4 2021. There are two major projects in the pipeline. First is the $1.6 billion, 1.7 MSF Research and Development District (RaDD) being developed by IQHQ on San Diego’s Pacific coastline. Sterling Bay and Harrison Street have broken ground on the $650 million Pacific Center, a 500,000 SF campus in Sorrento Mesa set to open in Q4 2024.

Even though there is a substantial amount of sublease space on the market (420,000 SF) and availability is approximately 15.7%, asking rents are at an all-time high, at $6.65 NNN, with Del Mar Heights/Torrey Hills cresting $7 PSF. Another positive factor is that demand continues to be strong, with a reported 1.7 MSF of requirements in the market — mostly large pharmaceutical companies.

“In terms of life science occupancy, we’re still at 89% here in San Diego. Although it’s down 3% year over year, it is still a pretty healthy occupancy rate, which is a testament to the robust ecosystem we have here. And even with VC funding pulling back, we are still seeing positive absorption quarter over quarter; it’s just not on pace with new deliveries as we expected mid-pandemic. The key to deal flow is the recycling of VC capital that is deployed. Firms are looking for exits of their current holdings to fund new technologies and drive user demand. Fortunately, we are starting to see a pulse in fundings and biotech IPOs in Q1 of 2024, giving hope that systems are coming back online,” states Durbin.

Los Angeles County

While LA has long lagged behind its sister life science clusters in the state, it continues to gain momentum. According to the statewide industry group California Life Sciences, Los Angeles/Orange County employed 134,739 workers in 2022. The region also attracted $3.43 billion in venture capital in 2022 and $1.2 billion in the first six months of 2023 (according to PitchBook), as well as a combined $2.25 billion in NIH awards.

UCLA completed a $700 million acquisition of the 587,000 SF Westside Pavilion mall at the close of 2023 that will transform the asset into UCLA Research Park, a hub for the new California Institute for Immunology and Immunotherapy at UCLA and the UCLA Center for Quantum Science and Engineering.

The Outlook

Despite lingering economic headwinds and a rise in occupancy rates due to new construction, the long-term prospects for the life science industry remain strong due to continued funding and job growth. Industry observers anticipate robust demand for lab space when venture capital ramps back up. California will continue to be a major life science hub, driven by its three top 10 life science clusters.

“I think there’s still a lot of hesitation regarding investments and leasing compared to the boom we had during the pandemic,” says Durbin. “But the common theme at the recent RevistaLab conference was a generally positive long-term outlook for the life science sector. In addition to rapid advancements being made with technology, FDA submissions and approvals are at an all-time high. I believe we are accelerating into a new stage of growth with life science and biotechnology with strong demand for lab space long-term.”

As a testament to San Diego’s prominence in the life science world, the BIO International Convention — the largest and most comprehensive event for biotechnology, with over 20,000 industry leaders from across the globe — will be held at the San Diego Convention Center on June 3–6, 2024.

To learn more about the life science market, contact Chris Durbin at Voit Real Estate Services.