Will Industrial Sales Heat Up in 2025?

The election is over, inflation appears to be in check, and interest rates are coming down. How will the Southern California industrial market respond?

For the past few years, sales for industrial properties have tailed off considerably from 2021’s record-setting $125.7 billion in trades. That year, industrial sales blew away 2019’s pre-Covid volume of $112.1 billion — the highest annual level since 2001 — mainly due to the pandemic-fueled change in consumer behavior that drove vacancy rates for warehouse/distribution facilities to historic lows.

That trend shifted downward when the Federal Reserve began raising interest rates in March 2022 to combat inflation. As a result, industrial transactions slowed dramatically in the final two quarters, and 2022 totaled approximately $90 billion in sales, according to CommercialEdge. Transaction levels continued to plummet in 2023, dropping to $52.1 billion as the Fed continued to raise interest rates. This year should be slightly better than last, with $49.2 billion in transactions recorded through October.

That trend shifted downward when the Federal Reserve began raising interest rates in March 2022 to combat inflation. As a result, industrial transactions slowed dramatically in the final two quarters, and 2022 totaled approximately $90 billion in sales, according to CommercialEdge. Transaction levels continued to plummet in 2023, dropping to $52.1 billion as the Fed continued to raise interest rates. This year should be slightly better than last, with $49.2 billion in transactions recorded through October.

As 2024 comes to a close, inflation is nearly down to the Fed’s target rate. The rate cuts that began in September are expected to continue. Forbes reported that the Federal Open Market Committee (FOMC) policymakers are projecting rates will likely be between 3% and 4% at the end 2025. In addition to the interest rate reductions, investors who were waiting for the results of the presidential election before making decisions on how to deploy capital may now move off the sidelines, with the new administration expected to create a favorable environment for commercial real estate.

“Once the uncertainty over the outcome of the election has passed, we expect to see a surge in lease and sales activity, as many business owners have put their requirements on hold until the first of the year,” noted Tony Tran, Regional Director of Research, in the Voit Orange County Q3 Industrial Market report.

Cautious Optimism

In an article on the 2025 Outlook for CRE for U.S. News, commercial real estate finance writer Glenn Fydenkevez says that “the CRE industry and the bankers and brokers who finance them are looking forward to 2025, and there is reason for cautious optimism. The CRE outlook for 2025 is one of increasing clarity, continued stabilization, and ample opportunity for intelligent and agile players.” In addition, a survey by the tax and consulting firm Deloitte & Touche found that 88% of the 880 CRE executives who responded said they expect their companies’ revenues to increase in 2025.

For industrial real estate, the continued increase in e-commerce sales should bolster demand. E-commerce accounted for 15.9% of the total retail sales in the United States in the first half of 2024 and is projected to total $1.22 trillion by the close of 2024 — an increase of nearly 11% over 2023. The market will continue growing at a compound annual growth rate (CAGR) of 8.99% until 2029 and reach $1.88 trillion. The trend of onshoring manufacturing due to the Inflation Reduction and CHIPs Acts should also increase investor demand, including properties that can be retrofitted for new uses. Although vacancy rates increased in many markets nationally and in Southern California in 2024, the reduction in interest rates and the continued increase in consumer confidence should reduce vacancy rates in 2025, increasing investor demand.

Additionally, Moody’s Q3 Outlook reports that “After years of robust growth, the initiation of new construction projects has slowed, influenced by rising interest rates and diminishing demand. However, the recent reduction in interest rates may lead to an uptick in volume for projects that were previously shelved or halted during construction.”

Southern California Industrial Markets Overview

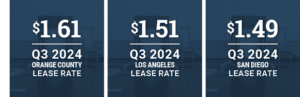

Despite the rise in vacancy in the Southern California markets (Inland Empire, Los Angeles, San Diego, and Orange County), most remained well below the national average – which increased steadily this year – of 7.2% in Q3, except the Inland Empire at 7.71%. SoCal Industrial is also commanding the nation’s highest rents, which average $0.73 nationally, with Orange County outpacing all markets at $1.61 and Los Angeles ($1.51) and San Diego ($1.49) on the Top 10 list for average asking rental rates.

Despite the rise in vacancy in the Southern California markets (Inland Empire, Los Angeles, San Diego, and Orange County), most remained well below the national average – which increased steadily this year – of 7.2% in Q3, except the Inland Empire at 7.71%. SoCal Industrial is also commanding the nation’s highest rents, which average $0.73 nationally, with Orange County outpacing all markets at $1.61 and Los Angeles ($1.51) and San Diego ($1.49) on the Top 10 list for average asking rental rates.

Institutional Investors, Large Owner/Users Active in Q3

Southern California markets were among the national leaders in industrial sales in 2024. Among major metros through October 2024, Los Angeles was in fifth place with $2.37 billion in transactions, the Inland Empire was ninth with $1.64 billion, and Orange County was 14th with $823 million, according to Commercial Edge. In San Diego, $633 million of industrial buildings traded hands through Q3.

Institutional investors were well represented on both the buy and sell sides. Boston-based Cabot Properties acquired the newly constructed, fully leased, 236,000 SF Almeria Logistics Center in the Inland Empire from the Transwestern Development Company for $77 million. Greenlaw Partners acquired a 171,000 SF business park in Cerritos (LA County) for $50 million.

Large-scale owner/users were also active in Q3, with McMaster-Carr Supply Company acquiring a four-building industrial complex in Santa Fe Springs from Brookfield Asset Management for $75 million. As evidence of the strength of the SoCal industrial market, Brookfield acquired the asset in 2019 for $45.5 million. In a deal directed by Todd Holley, SIOR, SVP/Partner, local company Best Fit Movers purchased a 44,278 SF industrial building in Otay Mesa from a local development company that completed construction of the building in the second quarter of 2024.

Large-scale owner/users were also active in Q3, with McMaster-Carr Supply Company acquiring a four-building industrial complex in Santa Fe Springs from Brookfield Asset Management for $75 million. As evidence of the strength of the SoCal industrial market, Brookfield acquired the asset in 2019 for $45.5 million. In a deal directed by Todd Holley, SIOR, SVP/Partner, local company Best Fit Movers purchased a 44,278 SF industrial building in Otay Mesa from a local development company that completed construction of the building in the second quarter of 2024.

Outlook for the Owner/User Market

“Owner/user activity has been sluggish since interest rates ramped up in late 2022, but now that they are heading back down again, activity seems to be picking back up,” reports Tony Tran. The anticipated market correction didn’t materialize as supply and demand decreased simultaneously, maintaining near-peak prices. Buyers faced premium prices and rates, resulting in debt service exceeding market lease rates. However, with more favorable mortgage rates, the buy vs. lease equation is rebalancing, potentially revitalizing the owner/user market. There is one caveat, however. A lack of inventory may be a persistent problem. Existing owners may not be inclined to give up their 3% mortgages to acquire new facilities, given that interest rates are now double the pre-2022 rates.

Tran adds that the market for spaces and buildings under 25,000 SF will tighten even further. “If mortgage interest rates keep decreasing, we could see a resurgence in owner/user activity for buildings under 25,000 SF that can be financed with SBA fixed-rate loan packages and down payments as low as 10%.”

One emerging niche market is IOS. Alex Jize, SIOR, VP/Partner, reports that investors and owner/users are pursuing industrial outdoor storage (IOS) properties – which rarely come to market. One deal highlighting the demand for these assets was brokered by Patrick Connors, SIOR, SVP/Partner, and Michael Mossmer, SIOR, SVP/Partner. The pair successfully directed the $7.3 million sale of a 2.06-acre-industrial parcel with a 4,500 SF building in National City. The Voit team represented the seller, Wentworth Property Company, which sold the property to owner/user Macias Consulting Services, LLC, a fleet services company based in San Diego.

One emerging niche market is IOS. Alex Jize, SIOR, VP/Partner, reports that investors and owner/users are pursuing industrial outdoor storage (IOS) properties – which rarely come to market. One deal highlighting the demand for these assets was brokered by Patrick Connors, SIOR, SVP/Partner, and Michael Mossmer, SIOR, SVP/Partner. The pair successfully directed the $7.3 million sale of a 2.06-acre-industrial parcel with a 4,500 SF building in National City. The Voit team represented the seller, Wentworth Property Company, which sold the property to owner/user Macias Consulting Services, LLC, a fleet services company based in San Diego.

As we enter 2025, Southern California remains a prime market for investment and development. Despite increased vacancy rates in 2024, the region’s strong fundamentals, high rental rates, and strategic location position it for continued growth. As the market stabilizes and investor confidence returns, industrial real estate is poised to regain momentum and offer attractive opportunities for both investors and owner/users.