Disposition Options for Owner/Users

Most San Diego-based business owners who acquire industrial or office property for their own use, do so for a reason: To control their occupancy cost and build equity over time through value appreciation and principal pay-down on debt; rather than doing the same for a landlord by paying rent.

It is a time-tested model that has been around for decades, and literal fortunes have been made as a result.

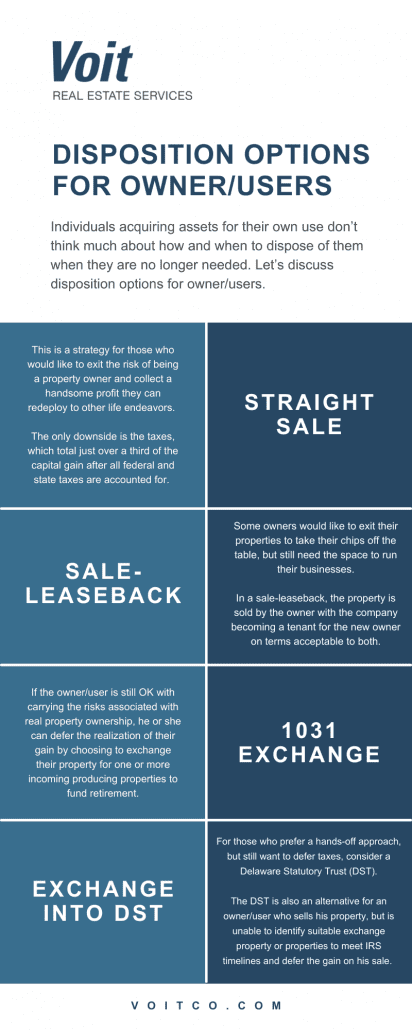

It is also true that individuals acquiring assets for their own use don’t think much about how and when to dispose of them when they are no longer needed to run their operations.

Let’s discuss disposition options for owner/users that are available.

Disposition Options for Owner/Users

Generally, owner/users are long-term holders and keep their properties even when the space no longer fits their operational needs. Some businesses grow and space gets tight, while others contract or change to the point that the space is no longer needed.

A common thread in the owner/user community, however, is to hold until there is a compelling reason to make a change—rather than to respond strategically to changes in the marketplace that could enhance the financial position of the owner.

Today’s market conditions present such an example. Prices have risen to a level that is more than double the previous market peak, and many long-term owner/users are nearing or have reached retirement age. That’s a powerful combination of circumstances that would, logically, give rise to thoughts of selling or exchanging into an income-producing property to fund a comfortable retirement. Yet, the vast majority of owner/users continue to stand pat.

Why is that?

Our experience is that owner/users are not fully informed of the various options available to them, or the advantages each holds for them depending on their unique circumstances.

Here’s a quick rundown of the options available to them.

Straight Sale

This is a strategy for those who would like to exit the risk of being a property owner and collect a handsome profit they can redeploy to other life endeavors.

Some want to travel. Some choose to relocate and upgrade their lifestyles. Others choose to pay off other debts and reduce the financial pressures associated with running their businesses.

The only downside to a straight sale is the taxes, which total just over a third of the capital gain after all federal and state taxes are accounted for. That fact is enough to chase a lot of people away from an outright sale as soon as they hear it. But, what they would keep at today’s price point is still beyond what they ever expected when they acquired their properties.

Sale-Leaseback

Some owners would like to exit their properties to take their chips off the table, but still need the space to run their businesses.

In a sale-leaseback transaction, the property is sold by the owner with the company becoming a tenant for the new owner on terms acceptable to both.

In the past, this tended to yield a lower sales price than selling the property unoccupied to another owner/user. But, market rents have risen to a point that when a market capitalization rate is applied, sales prices can be even higher in a sale/leaseback scenario.

The only downside is the seller’s company pays more in rent to the new owner than it is accustomed to paying.

1031 Exchange

If the owner/user is still OK with carrying the risks associated with real property ownership, he or she can defer the realization of their gain by choosing to exchange their property for one or more incoming producing properties to fund retirement.

In fact, real property is the last remaining asset class that can be exchanged through IRC 1031 rules, which are explicit and must be followed to the letter to assure a successful tax-deferred exchange.

Often, owner-users will exchange their facilities for multiple other product types like single-tenant-net-leased retail buildings, office buildings, or multi-family properties as a way to:

- Diversify their portfolios

- Reduce risk, and

- Get cash flow from multiple sources

Exchange into DST

For those who prefer a hands-off approach to managing their investments, but still want to defer taxes via a 1031 exchange, a Delaware Statutory Trust (DST) can be a good option.

In a DST, the owner/user exchanges his property into a fractional interest in a pool of properties owned and operated by a Delaware Statutory Trust (DST). The DST option is less hands-on in terms of managing assets, but the professional services required to operate a DST can be expensive, which will impact cash flow.

The DST is also a good alternative for an owner/user who sells his property but is unable to identify suitable exchange property or properties in time to meet IRS timelines and defer the gain on his sale.

Whatever the owner/user decides to exchange into based on individual preferences, he or she becomes a landlord by redeploying equity into other real estate (whether it’s in San Diego or elsewhere) that produces good income and may have even more growth potential than the existing property.

1031 exchanges can be structured as either totally or partially tax-deferred, in case the owner wants to keep some cash from the sale and realize a portion of their gain.

The exchange model can also be used in a sale-leaseback transaction. In that event, the owner’s company keeps the space it operates from and the owner redeploys the proceeds of the sale to other assets, with no tax bill to pay.

A Final Word

The foregoing is just a snapshot of the basic disposition options available to owner/users. What’s right for you depends on what you want in terms of yield and risk, but also on quality of life issues that become more important as you approach retirement. Your Voit San Diego professional can assist you in analyzing all your options and help you choose the one that works best for you. Get in touch today.Interested in learning more about sale-leasebacks? Continue reading our article “The Sale-Leaseback Alternative.”