The CRE Outlook for 2025: “Cautiously Optimistic”

When it comes to forecasting the outlook for commercial real estate in 2025, the phrase that best sums up the collective thinking in the industry — from national observers to our brokers — would be “cautious optimism.”

There were some positive signs heading into 2025, most notably, three consecutive interest rate cuts totaling a full percentage point and an increase in CRE borrowing and lending activity, which gained significant momentum in the third quarter of 2024. Commercial and multifamily mortgage originations rose 59% compared to the same period in 2023 and 44% from the previous quarter, according to the Mortgage Bankers Association (MBA). The presidential election was completed, which most see as a positive for CRE as it creates certainty in the market. However, there are concerns over how potential tariffs and an aggressive deportation policy will affect markets.

There were also some negative trends. Long-term commercial borrowing rates rose. 10-year Treasury yields ballooned from 3.55% on September 16 to 4.8% on January 13 — a whopping 125 basis points in four months — which has slowed deal flow (although the rate decreased to 4.53 by January 29). Climate-related costs (hurricanes in the Southeast, wildfires in Southern California, etc.), including a spike in insurance costs in some markets, are also a reason for concern, as is the growing wall of loan maturities as lenders continue their “pretend and extend” policies.

Outlook by Sector

The office market continues to struggle as employers try to find the right balance for hybrid work (although return-to-office mandates may increase occupancy rates). The multifamily and industrial sectors continue to perform well. Retail has bounced back in a big way, with decade-high occupancy rates.

Multifamily

The national multifamily market recorded modest but steady gains in 2024, and the U.S. Multifamily Outlook, Winter 2025 from Yardi® Matrix expects moderate gains in the coming year. Advertised asking rents increased by one percent in 2024 through November, down from the 1.9% gain recorded in 2023, and well below the 21.4% gain recorded in boom years 2021 and 2022. Analysts forecast that rent growth will increase by 1.5% in 2025. Inventory expanded by 550,000 units but will decline to 508,000 units in 2025. Absorption totaled 370,000 units through November. New construction dropped in 2024 to 256,000 rental units, far below 2022, when 708,000 units started construction. This will lead to a drop in deliveries beginning in 2026, increasing rent growth.

For Southern California, USC’s Casden Multifamily Forecast predicts single-digit apartment rent increases through the middle of 2026. Inland Empire rents will see the most significant increases in the region at 7%. In San Diego County, apartment rents are expected to grow to $2,604 per month by mid-2026 from $2,471 last summer, a 5% increase, while vacancy rates are expected to increase to 3.7% from 2.1%. San Diego and Orange counties both experienced double-digit rent growth during the pandemic. Since 2021, San Diego County has added twice as many apartment units as Orange County.

For Southern California, USC’s Casden Multifamily Forecast predicts single-digit apartment rent increases through the middle of 2026. Inland Empire rents will see the most significant increases in the region at 7%. In San Diego County, apartment rents are expected to grow to $2,604 per month by mid-2026 from $2,471 last summer, a 5% increase, while vacancy rates are expected to increase to 3.7% from 2.1%. San Diego and Orange counties both experienced double-digit rent growth during the pandemic. Since 2021, San Diego County has added twice as many apartment units as Orange County.

On the investment sales side, Robert Vallera, CCIM, SVP/Partner in Voit’s San Diego office, expects transaction levels to be modest, with A-level properties seeing the least interest from investors. The bulk of the San Diego County apartment sales will be B and C product, much of which was constructed between 1965 and 1990. Those properties which have already been renovated to meet the expectations of 21st-century renters are now trading well below replacement cost, attracting long-term hold investors rather than “fix and flip” investors.

Rising post-pandemic construction costs are projected to have a significant long-term impact on the market. The combination of higher construction costs and elevated interest rates is crimping the front end of the development pipeline. Further impeding development has been the decrease in rents in San Diego, as landlords are reporting a 5–10% drop in rents achieved following apartment turnover over the past 24 months.

Office

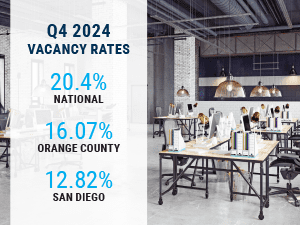

Moody’s Analytics reports that the national office vacancy rate hit a new record at 20.4% in Q4 2024, with average effective rents remaining flat. It is worth noting that vacancy rates vary wildly by market (San Francisco has an overall vacancy rate of over 30%, while Miami is in the single digits at a little under 10%). While improving in many markets, office utilization is still two-thirds of pre-pandemic levels.

In terms of investment sales, office properties sold at an average of $179 per square foot in 2024, down 9% from 2023’s average, following a 24% drop from 2022, according to Commercial Edge. Over a quarter of office properties sold below their previous transaction value in 2024. Keys to multiple trophy assets have been given back to lenders by some of the industry’s largest investors.

In terms of investment sales, office properties sold at an average of $179 per square foot in 2024, down 9% from 2023’s average, following a 24% drop from 2022, according to Commercial Edge. Over a quarter of office properties sold below their previous transaction value in 2024. Keys to multiple trophy assets have been given back to lenders by some of the industry’s largest investors.

In the Southern California markets, vacancy rates for Orange County and San Diego were 16.07% and 12.82%, respectively, according to Voit’s market reports, and transaction volumes through Q4 2024 rose 10.35% year over year in San Diego but fell 14.28% in Orange County.

Stefan Rogers, SVP/Partner in the Irvine office, says the 2025 California office market will remain in a transitional state as it continues to find its feet and recover from the turmoil of the COVID-19 era, adapting to what is still an evolving and very variable new workplace standard. The office market recovery is still very much undefined but broadly shaped by several key trends:

Hybrid Work Models: Most office-based businesses are expected to continue adopting hybrid work strategies, reducing the need for large office spaces. This trend is unlikely to change. This will continue to place upward pressure on vacancy rates, especially in central business districts where vacancy often exceeds 20% in Class A buildings.

Flight to Quality & Experience: Tenants will continue to prefer high-quality, energy-efficient office spaces with modern amenities, leaving older, less desirable buildings at risk of prolonged vacancies and obsolescence.

Economic Pressures: Economic uncertainty, rising interest rates, and inflation could constrain demand for office space, impacting lease negotiations and rental rates. High interest rates will continue to restrict landlords’ abilities to invest in tenant improvements or adapt their properties to modern standards.

Industrial

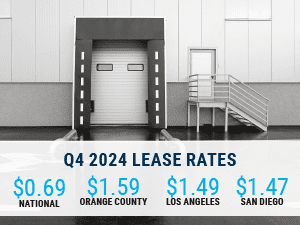

2024 was a year of stabilization and normalization for the industrial sector as the wave of new supply in most markets finally began to taper off. The national vacancy rate exploded to 7.5% in November, nearly 200 bps higher than the previous November (4.6%), according to Commercial Edge. Although dramatic, the vacancy is more in line with the long-term average for the asset class, compared to the historically low levels of the first couple of years coming out of the pandemic. The average lease rate was $0.69 ($8.27 annually), but Southern California markets were more than double that, including Orange County ($1.59), Los Angeles ($1.49), and San Diego ($1.47), according to Q4 Voit market reports.

2024 was a year of stabilization and normalization for the industrial sector as the wave of new supply in most markets finally began to taper off. The national vacancy rate exploded to 7.5% in November, nearly 200 bps higher than the previous November (4.6%), according to Commercial Edge. Although dramatic, the vacancy is more in line with the long-term average for the asset class, compared to the historically low levels of the first couple of years coming out of the pandemic. The average lease rate was $0.69 ($8.27 annually), but Southern California markets were more than double that, including Orange County ($1.59), Los Angeles ($1.49), and San Diego ($1.47), according to Q4 Voit market reports.

Investment sales totaled $54.6 billion through November, on track to match the 2023 total sales volume by the end of the year and traded at an average of $128 per square foot, marking a 2.7% price increase from last year. The Southern California markets trailed only the Bay area ($460) in price per square foot transactions, more than double the national average, with Orange County ($314), Los Angeles ($290), and Inland Empire ($270) holding the 2-4 slots on the list.

Let’s look at Voit broker’s forecasts for 2025 for the industrial market:

Sean Sullivan, SIOR, SVP/Partner in the Inland Empire office, says that there was a good deal of stagnation in the market in 2024 because the recovery that many had anticipated never fully materialized. With the election behind us — whether viewed as a positive or a negative — there is now a level of certainty in the market. In addition, interest rates have stabilized somewhat following the cuts, and the general feeling is that while rates may not go down much further, they aren’t likely to increase. Asset pricing has also stabilized; we’re no longer on that downward trajectory, so there should be an uptick in transaction volume.

There has also been a decline in new construction starts, which should help with the absorption of existing space. Until late last year, the Inland Empire consistently had 26 million square feet or more of warehouse/distribution buildings under construction for several years. Since then, the construction queue has been thinning, and Q4 2024 ended with just 10 million under construction, due in part to the reduced land acquisition activity over the last year.

Overall, he says he is optimistic going into 2025 and thinks we will see some positive momentum in terms of activity from buyers and tenants.

Further south, Brian Mulvaney, CCIM, SIOR, SVP/Partner in the San Diego office, says that the San Diego industrial market still faces notable challenges. Occupancy losses continued into the fourth quarter of 2024 — the eighth consecutive quarter of negative absorption, the longest stretch since the Great Recession. Vacancies have risen 2% over the past 12 months, from 4.5% to 6.5%, the highest level in nearly a decade. The market is navigating a period of weaker demand, particularly in the defense and biotech sectors, and is expected to persist into 2025 but should recover over the next 12 to 18 months.

Demand for multi-tenant and small-bay industrial properties (2,000 to 10,000 square feet) remains robust, with relatively high activity levels in these spaces. In contrast, larger logistics facilities are experiencing slower leasing activity, influenced by broader macroeconomic concerns. The availability rate for logistics buildings between 100,000 and 250,000 square feet has doubled over the past two years.

Despite these short-term challenges, long-term demand drivers remain strong, particularly in the South Bay and Otay Mesa submarkets, due to their strategic location and access to Mexico’s labor force. However, broader economic concerns may delay a full recovery in demand until late 2025 or even into 2026. The market is expected to face further occupancy losses in the near term as it adjusts to these changes but will recover due to the dynamic nature of the regional economy. The diversity of our local industries, which includes the presence of the military and defense contractors, our several research institutions and universities that produce spinoff companies, a strong tourism industry, and an ever-growing technology sector, make recovery certain.