Financing Commercial Real Estate: Part 2

Conventional Financing

In part one of our series on financing commercial real estate, we gave an overview of the unique characteristics of owner-user financing, primarily offered through the Small Business Administration’s (SBA’s) 504 loan program.

This program allows owner-users to borrow as much as 90% of the purchase price. Additionally, the program’s low long-term fixed rates allow businesses to stabilize their occupancy costs for up to 25 years.

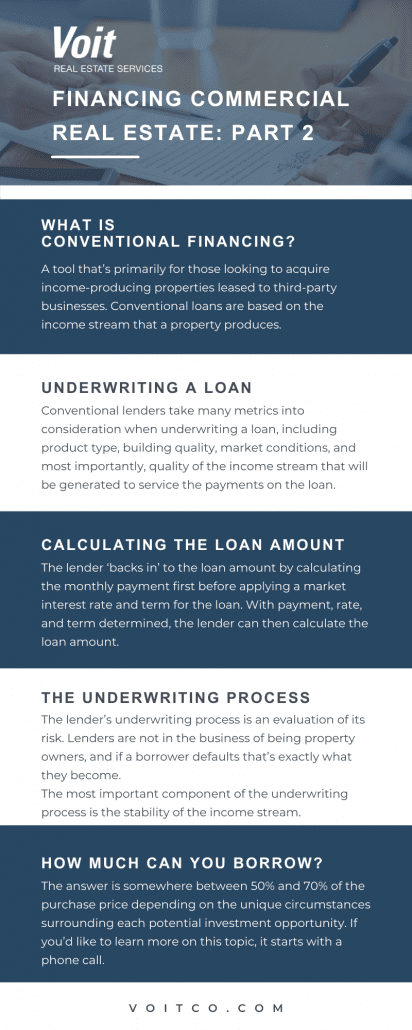

In this post, however, “Financing Commercial Real Estate: Part 2,” we’ll take a look at conventional financing: a tool that’s primarily for those looking to acquire income-producing properties leased to third-party businesses.

Conventional Financing: The Basics

These loans are markedly different from SBA loans and are underwritten using different metrics. The primary difference between the two approaches is that SBA loans are based on a percentage of the property’s purchase price, or loan-to-value ratio (LTV), while conventional loans are based on the income stream that a property produces.

Underwriting a Loan

A conventional lender takes many metrics into consideration when underwriting a loan. Among them are:

- Product type

- Building quality

- Market conditions

The most important component, however, is the quality of the income stream that will be generated to service the payments on the loan.

Lenders need to know that the income on a property is sufficient to cover the payments on the debt and that the owner of the property will still have enough cash flow to maintain the property in order to retain existing tenants and attract new ones when space becomes vacant.

The Importance of Net Operating Income (NOI)

The most important number they focus on is Net Operating Income (NOI). But first, what is NOI? NOI is a property’s cash flow after an allowance for vacancy (either actual or imputed) and operating expenses, but before debt service on the prospective loan.

They then apply a Debt Service Coverage Ratio (DSCR) to the NOI to determine how much of a payment the income stream can support. The DSCR usually ranges from 1.15 to 1.30 depending on a variety of factors. Assuming a DSCR of 1.25, the monthly NOI must exceed the payment on the loan by 25%.

So, a property that produces a monthly NOI of $12,500 will support a monthly loan payment of $10,000 ($12,500 divided by 1.25).

Calculating the Loan Amount

In essence, the lender ‘backs in’ to the loan amount by calculating the monthly payment first before applying a market interest rate and term for the loan. With payment, rate, and term determined, the lender can then calculate the loan amount.

Currently, most loans are made with a term (or amortization period) of 20 to 25 years. The interest rate is based on several factors including:

- Product type

- Market conditions

- Quality of the income stream

The Underwriting Process

The lender’s underwriting process is an evaluation of its risk. Lenders are not in the business of being property owners, and if a borrower defaults that’s exactly what they become.

This considered, the most important component of the underwriting process is the stability of the income stream.

Their preference is to loan on properties that are fully leased to creditworthy tenants on long-term leases. For example, a property fully leased to Amazon for 10 years is a property most lenders would compete to be the lender for. Many properties, however, are multi-tenant in nature with local tenants on leases expiring at different times under changing market conditions. The process can be complex and subjective in nature.

Evaluating the Quality of the Income Stream

It’s essential that you carefully evaluate the quality of the income stream when you are considering a property for acquisition.

That evaluation would include a thorough vetting of each tenant in terms of their credit, use type, time in business, and payment history, at minimum.

If there are multiple tenants, you’ll need to evaluate the ‘aging’ of the rent roll, meaning when each lease expires.

In a perfect world, existing lease expirations would be spread evenly so that you wouldn’t have too much of your space on the market in any given year. Every lender wants to see consistent income that will be sufficient to service the monthly payments throughout the term of the loan.

The same holds true for you as the potential buyer. You don’t want to see your NOI fall below a level that can service the debt, maintain the property, and have some leftover for you—the one whose capital is at risk.

How Much Can You Borrow?

So, after all the underwriting is done, how much will you be able to borrow? The answer is somewhere between 50% and 70% of the purchase price depending on the unique circumstances surrounding each potential investment opportunity.

That means you will have to make a substantial cash investment to acquire a property, much more so than an owner-user would. Your underwriting of a property must be every bit as critical and comprehensive as that of a lender.

It’s not all about price, either. You may be better off paying more for a high-quality, well-leased property at a higher price, than shop for a bargain and end up with a nightmare.

The foregoing is meant as a general overview of conventional lending but there is, of course, more to the process than we can pass along in a single post.

Your Voit professional has all the resources to assist you in your evaluation of potential investment properties and he or she can put you in touch with lenders who are active in your area and in the product type you are considering.

If you’d like to learn more on this topic, it starts with a phone call. We look forward to hearing from you.

And for those who haven’t already, read on for part 1 of our series on financing commercial real estate.