The State of Retail Markets

With Black Friday behind us and just three weeks left until Christmas, it’s time to take a look at how the retail markets are faring in 2025 and what the outlook is for 2026. We’ll begin with a national overview of retail trends, examine the Southern California market, and take a deeper dive into San Diego’s retail landscape.

Black Friday

Despite a decline in consumer confidence due to the government shutdown, a weakening job market, and persistent inflation, Black Friday exceeded most industry expectations. The good news is that sales were up 4.1% year over year (YOY). But the bad news for investors in retail assets is that while online retail sales rose 10.4%, brick-and-mortar sales rose only 1.7%, according to Adobe. RetailNext, which measures real-time foot traffic in physical stores, also found that U.S. Black Friday foot traffic fell 3.6% compared to 2024.

Despite a decline in consumer confidence due to the government shutdown, a weakening job market, and persistent inflation, Black Friday exceeded most industry expectations. The good news is that sales were up 4.1% year over year (YOY). But the bad news for investors in retail assets is that while online retail sales rose 10.4%, brick-and-mortar sales rose only 1.7%, according to Adobe. RetailNext, which measures real-time foot traffic in physical stores, also found that U.S. Black Friday foot traffic fell 3.6% compared to 2024.

On a brighter note, the National Retail Federation is projecting that 2025 total holiday retail sales (November and December) will be up between 3.7% and 4.2% year over year, as it expects U.S. consumers will continue to spend despite declining sentiment.

National Retail Trends

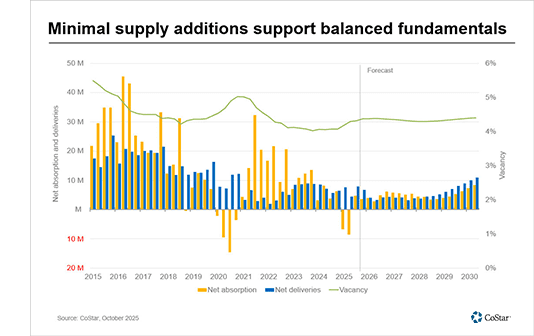

2025 saw a huge YOY increase in store closings, with nearly 6,000 closures totaling over 120 million square feet in the first half of 2025 alone, according to Coresight Research. Rite Aid (1,100), JoAnn Fabrics (800), and Party City (738) lead the store closings, which were far more than 2024’s 3,960 closings (75 MSF) during the same time period. Despite the elevated number of closings, CoStar pegs the national retail vacancy rate at 4.4% in a November release. Earlier in the year, Neil Saunders, a retail analyst and managing director of analytics firm GlobalData, told Costar, “There have certainly been some high-profile failures this year, but a lot of space that’s come on the market has been quickly re-leased. Vacancy rates remain relatively low.”

Although the pace of store closures slowed down in Q3, they’re expected to remain elevated over the coming quarters. Net absorption is forecasted to average 3.8 MSF per quarter in 2026, well below the prior five-year average of 9.8 MSF.

Leasing demand overall is led by discounters, dollar stores, quick-service restaurants (QSRs), health/wellness, and daily-needs retailers, while soft goods and some specialty categories remain more selective. Vacancy for well-located, necessity-anchored and higher-quality open-air centers stays low, often more than 100 bps below other retail formats, supporting rent growth and landlord pricing power into 2026.

Off-Price, Luxury Brands Thriving

The retail market is becoming increasingly bifurcated, especially in apparel and dining, according to Placer.ai research. Companies like Target and Kohl’s have reported decreased same-store sales, while luxury and off-price retailers are doing well. At one end of the spectrum, off-price clothing brands and thrift stores are booming as consumers become increasingly value-conscious. T.J. Maxx, whose brands include Marshalls, HomeGoods, Homesense, and Sierra, recently announced that it plans to open an additional 2,000 stores. And in Q2 2025, visits to thrift stores were up 39.5% compared to Q2 2019. On the other end of the spectrum, premium brands continue to attract affluent customers who are less sensitive to economic headwinds, though luxury brand sales growth is more modest than that of off-price stores.

Upscale full-service restaurants (FSRs) are outperforming their casual dining counterparts as affluent consumers continue to spend. At the same time, lower- and middle-income households face significant cost-of-living pressures as fast-food chain menu prices rise. So, QSRs and FSRs have underperformed in 2025.

Despite macroeconomic challenges, Placer.ai research states that asking rents for retail space generally held firm in 2025. Landlords retained pricing power in high-demand corridors, especially those with strong demographic profiles or tourism tailwinds. New retail construction remained limited, with developers cautious amid elevated financing costs and an uncertain economic outlook. The focus continues to shift toward repositioning existing assets rather than speculative ground-up development, particularly in markets with shifting consumer behaviors.

Southern California Retail

According to a recent report by the Southern California Chapter of the Appraisal Institute, Southern California’s retail real estate sector has proven remarkably resilient through 2024–2025, adapting to e-commerce pressures and pandemic aftermath better than many expected. Retail vacancy rates are in the low-to-mid single digits in most SoCal submarkets, and consumer demand for brick-and-mortar space remains solid, especially in experiential and necessity retail.

Overall retail vacancy in SoCal has hovered around 4% to 7%, depending on the area and center type. Rates have risen slightly over the past year as a few big-box store closures left holes. But vacancies remain relatively low, and quality retail space is scarce in prime locations. Landlords report that well-located neighborhoods and community centers are near full occupancy, and they quickly backfill vacated storefronts.

Smaller-format stores and service businesses primarily drive leasing activity: discount retailers, quick service restaurants, medical clinics, fitness studios, and other internet-resistant uses are expanding. Dollar stores and ethnic grocers have been taking some vacated mid-size boxes, and fitness chains are back in expansion mode in SoCal.

The retail investment market in SoCal is gaining traction, particularly for necessity-based centers. Cap rates for top-tier grocery-anchored centers and net-leased retail in SoCal compress to the 5–6% range, as these are seen as stable cash-flow assets. Total retail property sales volumes are still below pre-pandemic levels, but there is active trading of single-tenant properties (restaurants, drugstores, etc.) and increased interest in open-air centers. Investors particularly like SoCal retail locations with high barriers to entry and dense populations.

New retail construction in Southern California is extremely limited. High construction costs and cautious lenders mean very few ground-up retail projects. Instead, the trend is the redevelopment of existing retail — turning dead malls into mixed-use projects, renovating older centers, or adding drive-thrus and pad sites to existing centers. Because virtually no new shopping centers are being built, the supply side is constrained, helping keep vacancy low and supporting rent stability.

Focus on San Diego Retail

Voit’s San Diego Q3 2025 retail market report indicates that while vacancy remains in line with the national numbers at 4.5%, store closures, declining consumer confidence, and economic uncertainty have contributed to an increase in the availability rate of more than 3/4 of a percentage point YOY. One of the primary reasons the vacancy rate remains low is that many mall owners do not market all their available space in the open market. Additionally, inventory remains low despite millions of square feet of retail space built in the last decade, because obsolete retail sites are being repurposed for “higher and better uses,” such as multifamily. Asking rental rates remain flat at $2.36, essentially the same rate as Q3 2024.

Voit’s San Diego Q3 2025 retail market report indicates that while vacancy remains in line with the national numbers at 4.5%, store closures, declining consumer confidence, and economic uncertainty have contributed to an increase in the availability rate of more than 3/4 of a percentage point YOY. One of the primary reasons the vacancy rate remains low is that many mall owners do not market all their available space in the open market. Additionally, inventory remains low despite millions of square feet of retail space built in the last decade, because obsolete retail sites are being repurposed for “higher and better uses,” such as multifamily. Asking rental rates remain flat at $2.36, essentially the same rate as Q3 2024.

Lease transactions through Q3 fell from an annualized pace of 2.3 MSF in 2025, down from the 3.1 MSF recorded in 2024. However, retail sales were robust with 81 retail buildings sold for a total of $361 million in Q3. The quarterly sales volume has now exceeded $300 million for six consecutive quarters, compared to only two in the preceding six quarters. Some of those sales include properties that will be converted to “higher and better uses.” But the largest sale of Q3 — the $71.5 million acquisition by Steerpoint Capital of the 727,000 SF Shoppes at Carlsbad — will remain retail as they invest $4 million in upgrades.

The report also includes commentary from San Diego associate Tanner Ifrid, who provides an in-depth look at the QSRs that stand out as among the most resilient and liquid single-tenant net-lease assets in Southern California. Download the Q3 Retail Report to read the full editorial.