What Do Fed Rate Cuts Mean for CRE?

Two weeks ago, the commercial real estate industry received a boost when the Federal Reserve finally delivered its long-awaited benchmark interest rate cut. The larger-than-expected half a percentage point cut lowered the rate to 4.75% – 5.00%. This was the first rate cut in over two years and followed 11 consecutive rate hikes aimed at curbing inflation, which peaked at 9.1% in June 2022. During the announcement, the Fed indicated it would cut the rate by another half a percentage point this year. An additional four cuts are expected in 2025 and two in 2026.

Last Friday, there was more encouraging news when inflation moved closer to the Fed’s target. The Fed announced the 12-month inflation rate for August was at 2.2% – down from 2.5% in July and the lowest since February 2021. Following that announcement, Reuters reported traders bet that “the Federal Reserve is likelier than not to deliver a second 50-basis-point interest rate cut in November.”

So, what does this mean for the CRE industry?

A Psychological Boost

Following the rate cut announcement on September 18, the overall consensus was that it was too small to have any real impact on the CRE markets. However, in a recent article, CRE data provider Lightbox made the point that the rate cut will deliver a psychological boost to the market because it signals a commitment by the Fed to stimulate economic growth. The knowledge that the hoped-for economic “soft landing” is possible should also ease fears of an economic slowdown, which in turn should motivate investors and developers to come off the sidelines.

There were signs of increased activity in the market even before the rate cut. Transactions were down 5% from a year earlier to $203.8 billion, according to MSCI Inc. But lately, transaction volumes are showing “steady” improvements, the data provider said in a report.

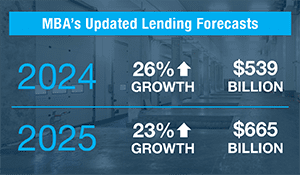

In August, the Mortgage Bankers Association (MBA) — predicting slower growth than initially expected — revised its CRE lending forecasts for 2024 and 2025. These downward revisions were relatively small and still project significant growth. The updated 2024 forecast projects a 26% increase in total commercial real estate lending, reaching $539 billion. This is down from the earlier estimate of 34% growth to $576 billion. For 2025, the forecast has been reduced to 23% growth, with total lending expected to hit $665 billion. This is down from the previous projection of 24% growth to $717 billion in lending. Over half of the loans for each year are for multifamily assets. “The outlook for 2024 and beyond points to growing confidence among investors’ return to the market,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research.

The news gets better. On a recent “CRE Weekly Digest” podcast, Lightbox research director Diane Crocker reported a few interesting tidbits. She attended a CREW Network Convention panel discussion moderated by Woodwell. Diane relayed that he said the response to the first rate cut was that the mentality has quickly shifted from “risk off to risk on.” And while most would expect that loan originators would be slow to respond to the initial rate cut, a representative from multifamily lender Lument said she “had 12 new deals land on her desk the day of the cut.”

Refinancing

Trepp estimates that 30% of the outstanding CRE debt (roughly $1.7 trillion) is scheduled to mature between 2024 and 2026. The lower interest rates (including those anticipated through 2025 and 2026) will positively impact the availability of financing for both new and existing properties and ease the challenges faced by those seeking loans. These rate reductions significantly increase the likelihood that debt holders will have less trouble refinancing their maturing loans next year. Additionally, lenders may have greater confidence in extending loans to worthy struggling properties, allowing owners more time to improve their performance.

The Risks

Despite the positive outlook for the CRE industry, the rate cuts are not without risk. In a report penned for NAIOP by Morris A. Davis, PH.D, Academic Director of the Center for Real Estate at Rutgers Business School, he opined that “all in all, the decline in rates will be good for commercial real estate.” Davis cited the rise in bank profitability that will free up cash to banks and enable them to make more loans with lower DSCRs, LTVs, and interest rates. This enables firms to bid more aggressively for deals, pushing up prices and transaction volumes.

However, he cites two instances that could possibly backfire on the economy. The first risk is that inflation may remain higher than 2%, the Fed target. “If inflation hovers at, say, 3%, the Fed may wish to keep rates high until it concretely sees a sustained period of inflation at or below 2%,” he states. This will delay Fed loosening.

The second risk is that “something bad” (presumably a black swan event?) happens that triggers a recession. “In this scenario, we should expect aggressive and large Fed rate cuts, possibly to 0,” he states, noting that even with a large cut in rates, a recession would not be good for commercial real estate.

Owners and Investors Optimistic Heading Into 2025

Last week, Deloitte released its 2025 Commercial Real Estate Outlook, for which it surveyed more than 880 global chief executives across 13 countries. After two consecutive years where most global survey respondents expected revenue declines, 88% of respondents now report they expect their company’s revenues to increase going forward. Over 60% expect growth to be in excess of 5% year over year.

Only time will tell.