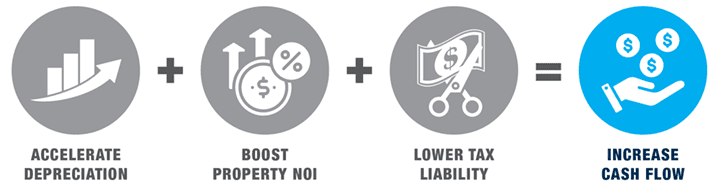

Property Owners, Looking to Increase Cash Flow? Try Cost Segregation

Commercial property owners using conventional straight-line depreciation for their assets may be missing an opportunity to reduce their overall tax burden through cost segregation.

What is Cost Segregation?

Cost segregation is a tax strategy that allows commercial real estate owners to accelerate the depreciation of individual building components, resulting in significant tax savings and improved cash flow by differentiating between real and personal property. Cost segregation involves identifying and reclassifying the various building components into shorter depreciation lives, typically 5, 7, or 15 years, instead of the standard 39-year depreciation period for commercial buildings (or the 27.5-year period for multifamily properties). Things like carpeting, wallpaper, furnishings, cabinetry, and land improvements like walkways, parking lots, and fences can qualify for faster cost recovery under the rules and generate more significant depreciation deductions over a building’s lifespan. Components like HVAC and specialized wiring may also qualify for shorter depreciation when they’ve been installed in certain medical or manufacturing facilities.

Benefits of cost segregation for commercial property owners include:

Increased Cash Flow

By front-loading depreciation deductions, cost segregation studies can significantly reduce a property owner’s tax burden in the early years of ownership, freeing up more cash.

Lower Tax Liability

The accelerated depreciation from cost segregation leads to lower taxable income and reduced tax payments over time.

Improved Property Valuation

Cost segregation can increase a property’s value by identifying assets that contribute significantly to its overall worth.

Higher Net Operating Income (NOI)

Reducing tax expenses through cost segregation can boost a property’s NOI, making it more attractive to potential buyers.

Reduced Audit Risk

A properly documented cost segregation study can help property owners avoid IRS audits and compliance issues related to depreciation deductions.

Improved Decision-Making

Cost segregation studies can provide valuable insights into a building’s energy efficiency, maintenance costs, and construction details, helping owners make more informed decisions about their properties.

Consult an Expert

While cost segregation offers many benefits, this is not a DIY operation. We consulted Joel Grushkin, Regional Director of Solana Beach-based Cost Segregation Initiatives (CSI), to see how commercial property owners can benefit from using cost segregation instead of straight-line depreciation. Grushkin says cost segregation “is a much more realistic approach to depreciating their real property, [as it] allows for the acceleration of depreciation, mitigating taxes in the early years of ownership when cash flow is most critical.”

The first step is to hire a firm like CSI that can provide a cost segregation study in compliance with IRS guidelines, preferably one certified by the American Society of Cost Segregation Professionals (ASCSP), which meticulously follows IRS regulations. The study typically involves a team of tax advisors and engineers working together to decide which building components should go into each category and how much each element is worth on its own. The study breaks the property down by using blueprints and as-built drawings, valuing building systems, subsystems, and components all the way down to unit cost levels. The database created by the study can then be used to allow the owner and their CPA to make decisions required by the tax code in determining whether an item can be expensed in the current year or must be capitalized.

Cost segregation can be used in all types of commercial real estate, whether it’s new construction, older buildings, recently purchased buildings, or ones acquired several years ago. If property owners did not perform a cost segregation study the year they acquired the property, they could still cash in on depreciation with a cost segregation look-back study. Based on IRS guidelines, a cost segregation look-back study can be performed on commercial or investment property that was put into service on or after January 1, 1987. “With ‘look-back’ studies, we go back to the date of acquisition by the current owner and re-create the depreciation schedule using the same methodology,” says Grushkin. “This allows the client to catch up on the depreciation they could have taken had they done a study right after purchase. Also, many of our clients have us run our numbers before purchase or during the pro forma stage so they can see what the real cash flow will be before finalizing a deal.”

Grushkin says cost segregation works with all types of commercial real estate assets but acknowledges that it is more beneficial to some product types than others. He currently has a long-term client doing their due diligence on a 15-property portfolio comprised primarily of warehouse/flex with some office. As soon as the client is preparing to close the deal, they will provide the building valuations and other pertinent data to CSI. “When they get to that level of detail. Then we can come back with an estimate of not only what it’s going to cost to do the study but an estimate of what we believe the benefit stream is going to look like,” says Grushkin.

How Much Can Property Owners Save?

Cost segregation studies typically make sense for commercial properties with a depreciable basis of $700,000 or more, but the benefits can be substantial. Grushkin offers this hypothetical example:

An investor purchases a medical building with a depreciable basis of $8,600,000. If they follow the standard formula of 39 years, the annual depreciation write-off would amount to $220,512. The actual savings depend on the individual taxpayer’s actual tax rate.

By investing in a cost segregation study, the team will discover that certain property components can be depreciated over shorter time frames. In this example, the property owner could depreciate $1,700,000 over five years for specialty electric, HVAC, specialty plumbing, etc., and $500,000 land improvements over 15 years. Using this method, nearly 25% of the building basis is eligible for accelerated depreciation. This is where the owner’s CPA determines the best way to use this depreciation expense for the client. Consideration must be given to current IRS provisions like bonus depreciation and how much is usable by the client. For properties acquired since mid-2017 thru 2022 as much as 100% of the items with a life of less than 20 years were eligible for a 100% bonus.

Potential Risks Associated with Cost Segregation

Upfront Costs

The cost of a professional cost segregation study can be significant, ranging from a reported $5,000 to $30,000. However, you can’t look at price without looking at the benefit stream that the study should yield. If the provider won’t offer a no-cost estimate, talk with another “Certified” provider.

Audit Risk

The perceived audit risk is one of the property owners’ concerns about cost segregation. The IRS maintains precise guidelines for conducting cost segregation studies, and any divergence from these guidelines might trigger an audit. That’s why hiring a qualified professional to perform the cost segregation study is essential, preferably one accredited by the ASCSP.

Recapture Provisions

When the property is eventually sold, the accelerated depreciation claimed through cost segregation will be subject to recapture provisions, resulting in ordinary income tax on those deductions. This can offset some of the initial tax savings.

Is Cost Segregation Right for My Property?

The benefits of cost segregation are enticing for commercial property owners looking to improve cash flow and reduce their tax liability. However, weighing the potential benefits against the upfront cost and long-term implications is essential. That’s why it is important to engage qualified and vetted professionals. For more information on whether cost segregation suits your property, contact a Voit Real Estate professional.